Explain the Features and Responsibilities of Different Business Structures Uk

Functional organisations are organised according to technological disciplines. Responsibility and decision-making power.

Business Structure Choosing A Business Structure Truic

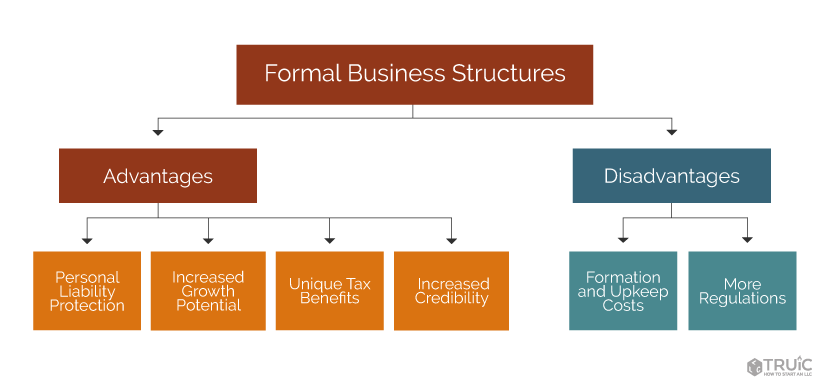

Potential tax advantages and simplicity of operating as a limited company this is one of the most popular business structures in the UK.

. Lines of communication are short making the firm responsive to change and decision-making quicker. A sole proprietorship is the simplest business structure and involves one individual who is responsible for the day-to-day operations of the business. This type of structure is more common within small to medium-sized businesses SMEs or within smaller independent business units of larger companies.

What is a Partnership. But and heres how you get to six or more types there is more than one type of company. To make matters more confusing they are all in a way correct.

5 Common Business Structures 1. Others say four six or even more. Learn more about the six business structures to chose which one is the.

Working as an integral part of your operations well also ensure you meet all your obligations under the Companies Acts. Organisations can also be divided into either functional or divisional structures. Except for those in positions at the very top such as owners or directors and those in entry-level positions.

Five common types of business structures. Types of business structure. The range of legal structures associated with different forms of business.

Forms of Business Structure. There are three main types of business structures to choose from for your business in the UK. We will arrange the formation of new companies and will deal with the following matters on your.

Becoming a sole trader. GOVUK tells you there are three basic types of business structure. A business structure is the type of company a business operates as and which affects how profits and losses are distributed.

What are the main six features and responsibilities of different business structures. An overview of the different legal structures you can choose. In a centralized structure the decision making power is concentrated in the top layer of the management and tight control is exercised over departments and divisions.

The different business structures are discussed in detail below. Shareholdings and shareholders agreements. Low cost easy to set-up.

Staff working in a flat management structure can be. All you have to do is inform HMRC that you intend to be self-employed and register your business name and you can start trading. It is responsible for all of its own debts and liabilities and your personal assets can never be touched to cover business obligations.

A sole proprietorship is the most basic and easiest type of business to establish. Accounting and control procedures. Limited Liability Companies LLCs Non-profit businesses.

Becoming a sole trader is the simplest legal structure for your business as it involves little form filling and you do not have to file accounts with Companies House companieshousegovuk. Once the company is incorporated information regarding the filing history and. Sole traders partnerships and private limited companies Sole Proprietorship A sole proprietorship also referred to as sole trader is a legal set up where the business is.

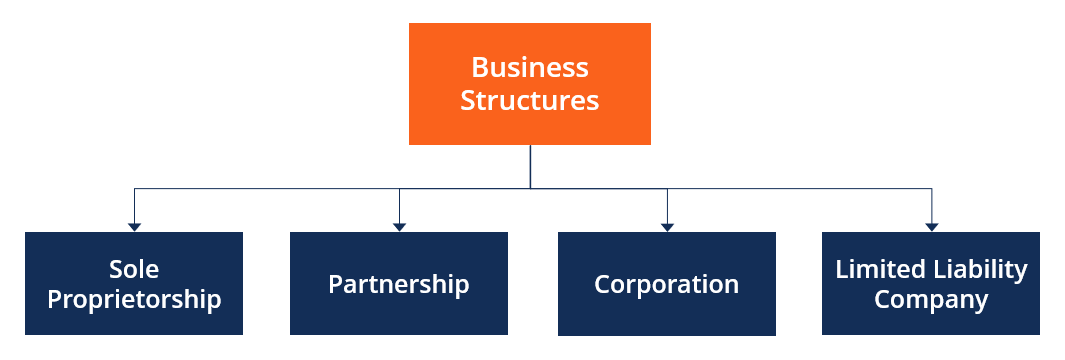

There are 4 main types of business structures in the UK and each has various tax and liability implications for owners and shareholders. Lets start with sole trader partnership and company. Leave a Comment Planning.

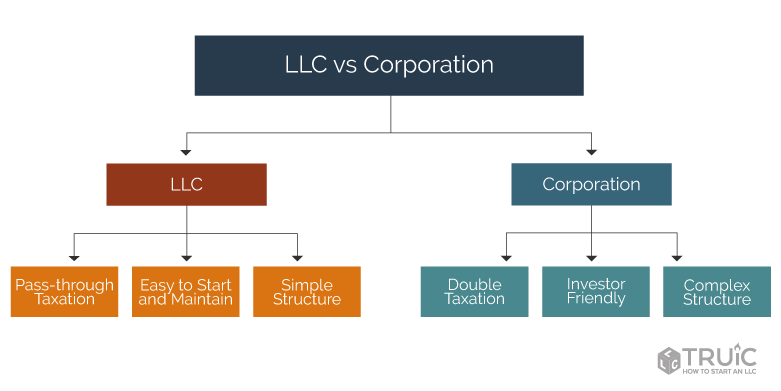

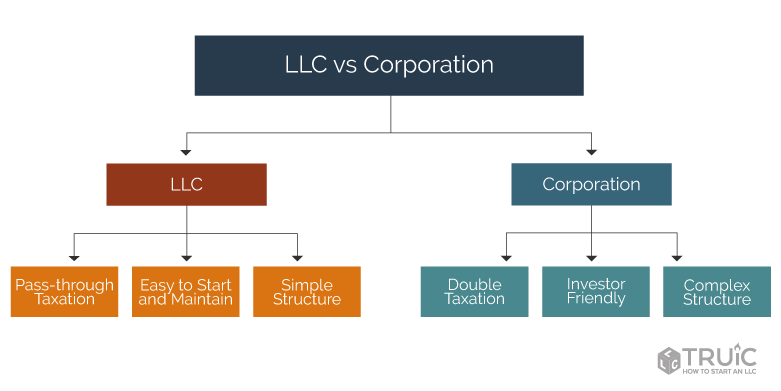

They vary in terms of scale liability and investors. It is also possible to start off with one structure and move to another one for example a sole proprietorship can expand to a limited liability company. Also from a tax perspective the incomes and expenses of the business are.

September 29 2017. Different organisational structures An organisational structure is how a business organises its staff to represent the different layers of management. A corporation on the other hand is a legally separate entity from you as the business owner.

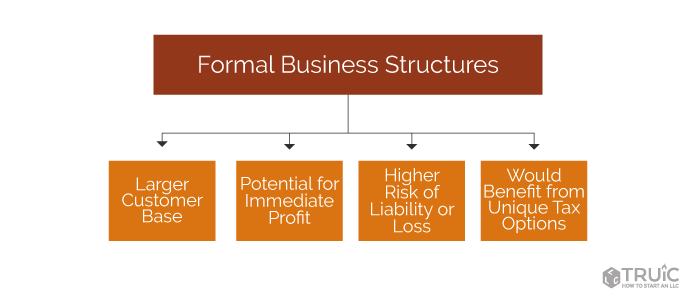

The economy of the United Kingdom can be divided into three main sectors. When it comes to choosing a business structure for your company there are a few options you have to choose from. The following types of businesses structures exist sole proprietorship partnership corporation limited.

The paperwork to be filled in to get started the taxes to be managed and paid. Youre entitled to all profits and are responsible for all your businesss debts losses and liabilities. There are several different business formats used in the UK.

The six business structure types you can choose from are. Directly or indirectly by the government or local make a profit but not When a business is started the structure chosen will define its legal responsibilities for instance. A business with one owner who has sole responsibility liability for all debts of business risks to own property and keeps the profits.

In this structure employees are ranked at various levels within the organisation with each level above the other. Full liability for debt. Owner of the business entitled to keep all profits but liable for all losses.

Here are the five most common types of structures to consider when youre starting a business along with their main advantages. In a decentralized structure the decision making power is distributed and the departments and divisions have varying degrees of autonomy. In a sole proprietorship structure one person owns the business and runs its.

Few levels of hierarchy. Theres no distinction between the business and you the owner. A business with shared ownership shared responsibility joint liability for all debts of business partners share profits or as agreed in deedpartnership common in professional services accountants solicitors veterinary surgery.

This corporate shield protects your personal assets from being taken on behalf of the business.

Business Structure Choosing A Business Structure Truic

Business Structure Choosing A Business Structure Truic

Business Structure Overview Forms How They Work

4 Types Of Business Structures And Their Tax Implications Netsuite

No comments for "Explain the Features and Responsibilities of Different Business Structures Uk"

Post a Comment